Introduction to the Sabka Bima Sabki Raksha Bill, 2025

Background and Legislative Journey

The Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025 marks a watershed moment in India’s insurance landscape. Introduced in Lok Sabha on December 16, 2025, the bill swiftly navigated through Parliament, securing approval from both houses by December 17, 2025. Finance Minister Nirmala Sitharaman personally moved the legislation for consideration, highlighting its strategic importance to India’s financial sector roadmap.

Prior to its parliamentary introduction, the bill received approval from the Union Cabinet, signaling strong governmental backing for this transformative insurance reform. Currently, the bill awaits the President’s assent before officially becoming law. Despite its expedited passage, several opposition members in Rajya Sabha voiced concerns, calling for deeper scrutiny through a Parliamentary committee review. Some also raised objections to the bill’s bilingual title, which combines both Hindi and English elements, according to Parliament records.

Core Objectives and Vision

At its heart, The Sabka Bima Sabki Raksha Bill aims to revolutionize Indian Insurance by democratizing access and working toward universal coverage by 2047. The legislation creates a framework to deepen insurance penetration across India’s diverse population while simultaneously improving business conditions for insurance providers.

The bill enhances regulatory oversight mechanisms and governance standards, as outlined in the official press release. It specifically targets accelerated growth in both life and General Insurance segments while strengthening policyholder protections.

These reforms are designed with the broader national goal of extending financial safety nets to individuals, households, and businesses nationwide. By fortifying the insurance sector, the bill aims to build greater economic resilience across India’s developing economy, as reported by financial analysts.

Acts Amended by the Bill

The bill comprehensively updates India’s insurance regulatory framework by amending three fundamental statutes:

- The Insurance Act, 1938 – The bedrock legislation governing insurance operations in India

- The Life Insurance Corporation Act, 1956 – The founding statute of India’s largest life insurer

- The Insurance Regulatory and Development Authority Act, 1999 – The framework establishing India’s insurance regulator

These amendments collectively enable significant reforms, including the much-discussed FDI 100% provision for foreign investment in Indian insurers, as industry experts note. By updating these interconnected statutes simultaneously, the bill creates a cohesive framework for the next phase of India’s insurance sector development.

Key Amendments and Their Impact on the Insurance Sector

Increased FDI Limit and Capital Augmentation

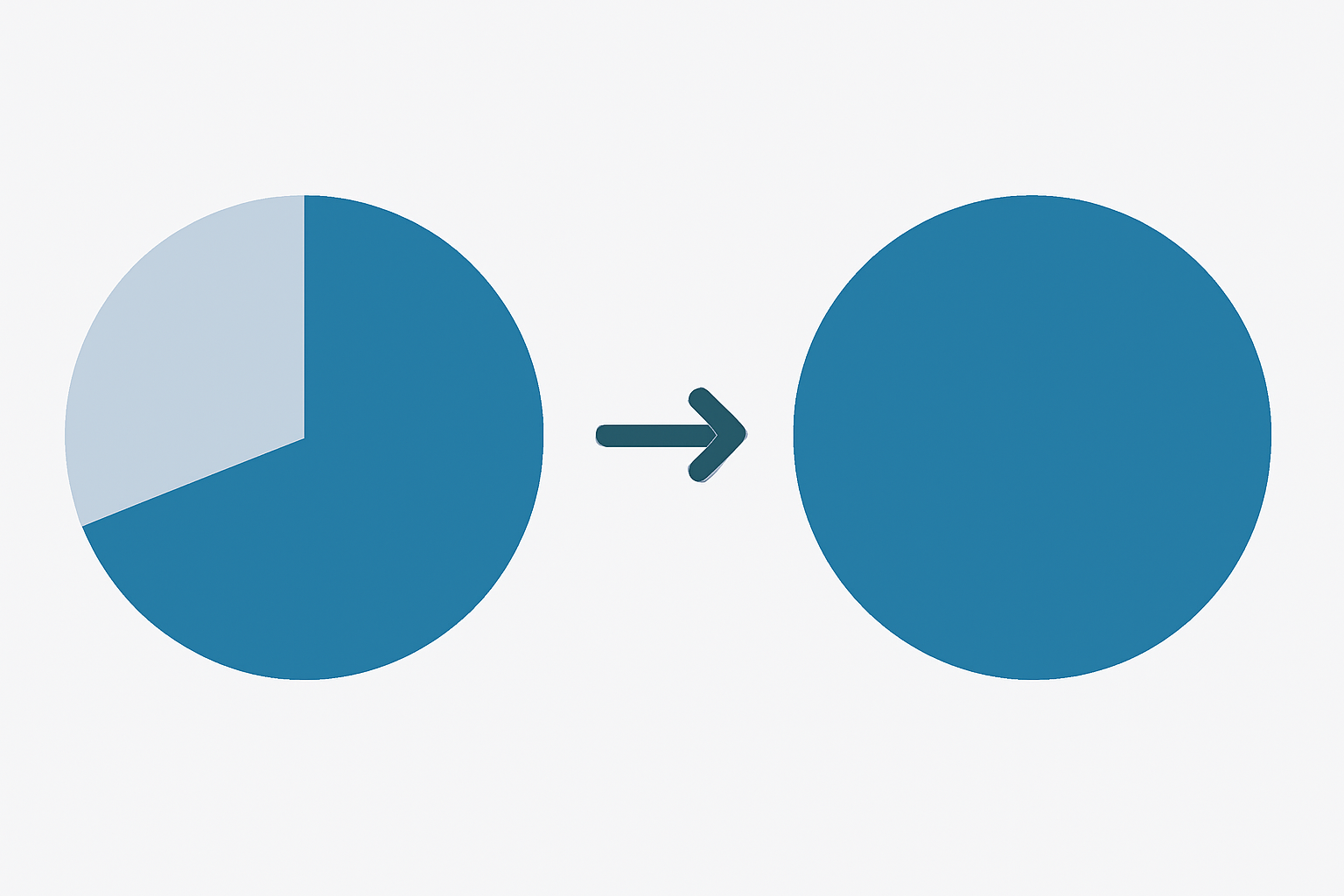

The Sabka Bima Sabki Raksha Bill introduces a landmark change by increasing the Foreign Direct Investment (FDI) limit in Indian insurance companies from the current 74% to 100% of paid-up equity capital.

This significant amendment is poised to transform India’s insurance landscape by attracting substantial foreign capital into the sector.

This significant amendment is poised to transform India’s insurance landscape by attracting substantial foreign capital into the sector.

The 100% FDI provision aims to address the long-standing capital constraints faced by the Indian Insurance market. With increased foreign investment, insurance companies can build stronger capital bases, essential for expanding their reach across India’s diverse and largely untapped market. According to PRS Legislative Research, this infusion of capital will enable insurers to enhance their risk-bearing capacity and develop more innovative products.

Despite allowing full foreign ownership, the bill safeguards national interests by mandating that at least one top executive (chairman, managing director, or CEO) must be an Indian citizen. This balanced approach aims to maintain a connection with local market realities while leveraging global expertise.

Industry experts anticipate that increased foreign participation will accelerate technology adoption and bring international best practices to the sector. The Ministry of Finance press release highlights that these changes are expected to create more jobs and drive efficiency through heightened competition.

Reforms for Ease of Doing Business

The Sabka Bima Sabki Raksha Bill introduces several measures to streamline operations in the insurance sector:

The bill reduces net-owned fund requirements for foreign reinsurance entities from Rs 5,000 crore to Rs 1,000 crore, making it easier for international reinsurers to enter the market. It also raises the threshold requiring IRDAI approval for share transfers from 1% to 5% of the insurer’s paid-up capital, reducing regulatory bottlenecks.

In a boost for cooperative insurance models, the legislation removes the Rs 100 crore minimum paid-up capital requirement for insurance cooperative societies offering life, General Insurance, and health insurance products. This change could significantly expand insurance access in rural and semi-urban areas.

The bill extends special powers for modifying regulatory provisions for insurers operating in International Financial Services Centres (IFSCs) within Special Economic Zones. As reported by Times of India, intermediaries will benefit from one-time licensing and more reasonable enforcement measures, with license suspension replacing immediate cancellation for violations.

The Life Insurance Corporation of India (LIC) gains greater operational flexibility to establish zonal offices domestically and align its international operations with local regulations.

Expansion of Insurance Intermediaries and Specialised Segments

The bill broadens the definition of insurance intermediaries to include managing general agents and insurance repositories, creating new business opportunities and distribution channels in the sector.

A major innovation is the introduction of sector-specific licenses that will allow insurers to specialize in targeted segments like cyber, property, or marine insurance.

This specialization should lead to more tailored products for specific risk categories.

This specialization should lead to more tailored products for specific risk categories.

The legislation empowers the government to notify additional business classes in consultation with IRDAI, enabling faster adaptation to emerging risk areas. For surveyors and loss assessors, the bill eases licensing requirements, shifting from statutory control to more flexible regulatory oversight.

These specialized segments will benefit significantly from the FDI 100% provision, as foreign insurers with niche expertise can now fully enter the Indian market.

Strengthening Regulatory Oversight and Policyholder Protection

Enhanced Powers of IRDAI

The Sabka Bima Sabki Raksha Bill significantly expands the Insurance Regulatory and Development Authority of India’s (IRDAI) oversight capabilities. Under the new provisions, IRDAI gains authority to approve arrangement schemes between insurance and non-insurance companies—a critical check against potential conflicts of interest in the Indian insurance sector.

Perhaps most importantly, the bill allows IRDAI to supersede an insurer’s Board of Directors when their business practices threaten policyholders’ interests. This represents a powerful safeguard for consumers against mismanagement or unethical corporate governance.

The regulatory body now holds expanded power to establish comprehensive regulations on compensation structures for insurance agents and intermediaries. This includes setting limits, requiring transparent disclosures, and ensuring fair practices in the commission system—addressing long-standing concerns about excessive commissions driving mis-selling behaviors.

Additionally, IRDAI’s investigative scope now extends fully to insurance intermediaries, closing a significant regulatory gap. The bill introduces a groundbreaking “disgorgement” mechanism allowing IRDAI to recover wrongful gains from both insurers and intermediaries, establishing a powerful deterrent against misconduct.

The legislation also implements standard procedures for regulation development with mandatory consultation requirements, ensuring industry stakeholder input while maintaining regulatory independence.

The Policyholders’ Education and Protection Fund

A landmark feature of the bill is the creation of a dedicated Policyholders’ Education and Protection Fund under IRDAI administration. This fund aims to safeguard policyholders’ interests while simultaneously addressing the knowledge gap in general insurance literacy.

Financing for this initiative will come from multiple sources: government grants, IRDAI contributions, penalties collected by the regulator, and donations from companies and institutions. Insurance experts view this fund as potentially transformative if implemented effectively, particularly in reducing the widespread problem of mis-selling that has plagued the industry.

Data Protection and Transparency Measures

The Sabka Bima Sabki Raksha Bill aligns insurance data handling requirements with India’s Digital Personal Data Protection Act (DPDP) 2023. This integration ensures robust safeguards for sensitive policyholder information across all insurance categories.

Insurers must now maintain comprehensive electronic records documenting policies and claims, including detailed rejection reasons and processing timelines. These records must be shared with IRDAI regularly, significantly enhancing the regulator’s visibility into systemic patterns and potential problem areas.

The legislation pushes the industry toward greater electronic servicing while establishing stricter standards for information accuracy, security protocols, confidentiality guarantees, and explicit consumer consent frameworks. This comprehensive approach represents a significant advancement in consumer protection within India’s rapidly evolving insurance marketplace.

Implications and Future Outlook

Potential Benefits for Consumers and the Market

𝐓𝐡𝐞 𝐒𝐚𝐛𝐤𝐚 𝐁𝐢𝐦𝐚 𝐒𝐚𝐛𝐤𝐢 𝐑𝐚𝐤𝐬𝐡𝐚 𝐁𝐢𝐥𝐥 promises substantial benefits for Indian consumers through increased market competition. With the FDI cap raised to 100%, the Indian Insurance sector is poised for a significant transformation.

This influx of foreign capital will likely drive innovation, compelling insurers to develop more efficient products and services to stay competitive.

This influx of foreign capital will likely drive innovation, compelling insurers to develop more efficient products and services to stay competitive.

The opening of doors to more international insurers will create a more vibrant marketplace. Consumers can expect a wider range of insurance products tailored to specific needs, more competitive pricing, and improved digital experiences. According to official government statements, these changes will directly benefit citizens through better service delivery and more affordable coverage options.

Enhanced capital inflow will strengthen insurers’ financial foundations, enabling them to take on larger risks and invest in cutting-edge technology. This improved financial resilience will translate to better claim settlement ratios and more innovative product offerings in both life and General Insurance segments.

The bill significantly bolsters IRDAI’s regulatory powers, creating a more robust framework for consumer protection. With strengthened oversight of insurer-policyholder relationships, consumers can expect greater transparency and fairness. The enhanced enforcement capabilities will help deter unfair practices, as industry analysis shows.

Challenges and Areas for Further Improvement

Despite its benefits, the bill has limitations. Experts describe it as “evolutionary rather than transformative” since it doesn’t fundamentally reshape the contractual balance between insurers and policyholders. Core legal protections remain largely unchanged.

The bill doesn’t establish specific claim settlement timelines or penalties – these crucial aspects still fall under IRDAI regulations. This regulatory approach has shortcomings, as many policyholders lack the resources to pursue complaints or litigation when issues arise.

Grievance redressal continues to be problematic. Insurance ombudsman offices face growing backlogs of complaints and claim disputes, resulting in long resolution times and enforcement challenges. For health insurance specifically, issues related to hospital documentation, investigations, and medical interpretations will likely continue to frustrate policyholders.

Vision for Universal Insurance Coverage by 2047

The legislation represents a crucial step toward India’s ambitious goal of universal insurance coverage by 2047.

The reforms aim to create a more resilient insurance ecosystem capable of supporting India’s growing economy. By expanding access and strengthening the sector’s foundations, the bill lays groundwork for broader financial inclusion.

The reforms aim to create a more resilient insurance ecosystem capable of supporting India’s growing economy. By expanding access and strengthening the sector’s foundations, the bill lays groundwork for broader financial inclusion.

As financial news reports indicate, these changes could transform insurance from a privilege to a fundamental financial safety net for all Indians, significantly contributing to the nation’s economic stability and growth in coming decades.

Leave a comment