The maritime industry stands at a crossroads. While traditional shipping losses have reached historic lows, a surge in geopolitical tensions, technological threats, and environmental challenges is reshaping the risk landscape. The Allianz Safety and Shipping Review 2025 offers an in-depth analysis of these evolving dynamics.

Maritime Losses at a Record Low

Record Low in Shipping Losses

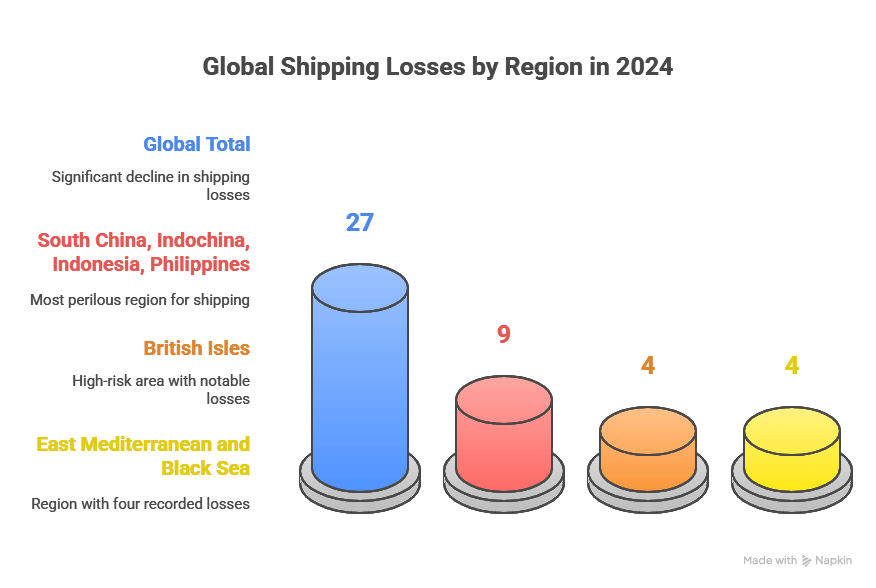

In 2024, the global shipping fleet recorded only 27 total losses, marking a 20% decrease from the previous year and a 75% decline since 2015. This significant improvement reflects enhanced safety protocols and technological advancements.

However, the South China, Indochina, Indonesia, and the Philippines region remains the most perilous, accounting for nearly a third of the vessels lost in 2024. Other high-risk areas include the British Isles and the East Mediterranean and Black Sea, each reporting four total losses. Over the past decade, these regions collectively contributed to 681 of the 729 total losses recorded globally

Escalating Geopolitical Tensions

Traditional causes of maritime losses, such as fires and collisions, have decreased over time. However, geopolitical tensions now pose a substantial threat that could offset these gains. The industry faces a complex environment marked by attacks on shipping, vessel detentions, sanctions, and damages to infrastructure such as critical sub-sea cables. Reports of vessels experiencing GPS interference and jamming are increasing. Insurers have seen a clear increase in large claims related to conflicts, notably from the war in Ukraine and Middle East tensions.

For instance, the conflict in Gaza led to over 100 ships being targeted by Houthi militants in the Red Sea, highlighting the vulnerability of global shipping to proxy wars and regional disputes. Additionally, piracy is resurging off the Horn of Africa, further exacerbating security concerns.

The Shadow Fleet: A Growing Menace

The rise of the shadow tanker fleet—vessels often lacking proper maintenance, insurance, and regulatory oversight—poses significant risks. Allianz estimates that this fleet comprises between 600 to 1,400 vessels, many of which are at the end of their operational lives. These ships are more prone to fires, engine failures, and collisions, increasing the potential for environmental disasters and insurance claims.Unregulated “shadow fleet” tankers often old, uninsured vessels engaged in sanction-evading oil trades are now estimated to make up 17% of the global tanker fleet. These ships pose serious safety and environmental hazards, with several high-profile incidents involving collisions, fires, and even suspected sabotage of undersea cables.

Fires and Misdeclared Cargo: Persistent Dangers

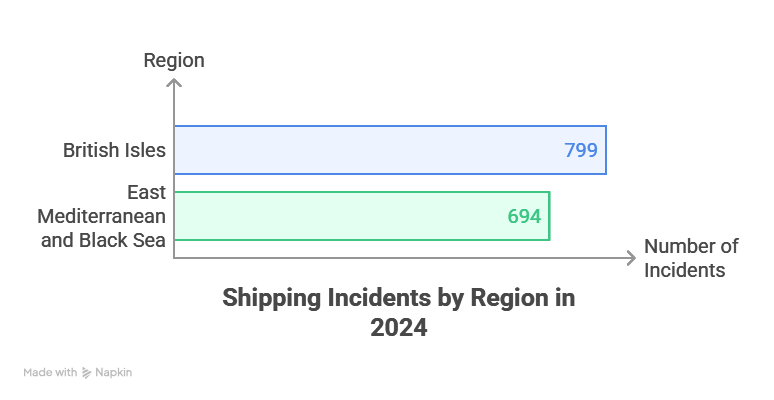

While total losses have decreased, the number of reported shipping incidents increased by approximately 10% in 2024, totaling 3,310 compared to 2,963 in 2023. The British Isles recorded the highest number of incidents (799), followed by the East Mediterranean and Black Sea (694). Over the past decade, the British Isles accounted for 20% of all reported incidents globally.

Machinery damage or failure was the predominant cause of incidents, responsible for over half of the reported cases (1,860). Fire and explosion incidents also saw a significant rise, with 250 reported in 2024—a 20% increase year-on-year and the highest total in a decade. This uptick is partly attributed to the transportation of lithium-ion batteries, commonly found in electric vehicles and other battery-powered cargo, which pose unique fire hazards.

Decarbonization and Climate Challenges

The maritime industry’s push toward net-zero emissions by 2050 is reshaping operations. Adoption of alternative fuels like LNG, ammonia, and methanol introduces new risks, including machinery failures and fire hazards. Allianz emphasizes the need for robust risk management strategies to navigate these challenges and ensure the safe transition to greener technologies.

Aging Fleet and Inflationary Pressures

Rerouted trade flows and constrained new builds have led to older vessels remaining in service longer, raising safety and maintenance concerns. At the same time, inflation and higher steel prices have driven up repair and insurance costs, making claims more expensive than ever.

Human Cost: Seafarers in Peril

The human element is under strain. A record 3,133 seafarers were abandoned in 2024, often due to ship detentions or bankruptcies. These numbers highlight a worsening crisis in seafarer welfare, exacerbated by global instability.

Cybersecurity and Technological Threats

Advancements in technology have introduced new challenges to maritime safety. The use of drones and unmanned aerial vehicles (UAVs) has become more prevalent, posing threats to ships through potential attacks or surveillance. These technologies are relatively inexpensive and accessible, raising concerns about their misuse by non-state actors or proxy groups.

Cybersecurity remains a critical issue, with increasing reports of GPS interference and AIS spoofing. These cyber threats can disrupt navigation systems and compromise vessel safety, necessitating robust cybersecurity measures and regular monitoring of technological vulnerabilities.

As shipping continues to evolve, Allianz stresses the need for robust risk management, technological innovation, and global cooperation to ensure the safe and sustainable future of maritime trade.

Access the Full Report

For a detailed analysis and comprehensive insights, you can access the full Allianz Safety and Shipping Review 2025 here: ALLIANZ Safety and Shipping Review 2025

Leave a comment